Netflix's (NFLX) $72 billion potential acquisition of Warner Bros. Discovery's (WBD) studio and streaming assets is drawing fire from Wall Street analysts who warn the deal could expose the streaming giant to significant risks from generative AI disruption.

Needham analyst Laura Martin argues Netflix is putting $83 billion in additional value at risk by taking on Warner Bros.' traditional studio operations just as artificial intelligence threatens to upend content creation over the next five years.

The deal announced last Friday combines Netflix's 300 million global subscribers with HBO Max's 128 million customers, creating a streaming behemoth that controls roughly 43% of the worldwide subscription video market. Netflix will pay $23.25 in cash and $4.50 in Netflix stock for each Warner Bros. Discovery share, valuing the transaction at $27.75 per share.

The acquisition includes the legendary Warner Bros. film library featuring franchises like Harry Potter and DC Comics, plus HBO's premium content, including Game of Thrones and The Sopranos.

Martin maintains her “Buy” rating and $150 price target on Netflix but warns the company would be better positioned without the legacy burdens of Warner Bros.' studio business. Without this deal, Netflix would remain more global, more nimble, more technology-first, and have greater flexibility with Hollywood unions. The streaming leader has built its success on being a builder rather than a buyer, making this acquisition a significant departure from its historical strategy.

Netflix stock is down almost 10% in the last five trading sessions as investors digest the regulatory and competitive implications. The transaction also faces scrutiny from antitrust regulators given the combined streaming market share, and Paramount (PSKY) has launched a hostile $30-per-share all-cash counteroffer directly to Warner Bros. shareholders. Netflix agreed to pay a $5.8 billion reverse breakup fee if regulators block the deal.

Netflix Is Bullish on the WBD Deal

Valued at a market cap of $440 billion, NFLX stock has returned close to 750% in the last 10 years. Earlier this week, Netflix co-CEOs Greg Peters and Ted Sarandos laid out their rationale for the blockbuster deal at a UBS conference. The streaming giant plans to spend roughly $30 billion annually on content after the merger closes, making it the largest entertainment spender globally.

The deal brings three new business lines with zero redundancies. For instance, Warner's theatrical distribution, third-party TV production, and HBO's prestige brand all operate independently of Netflix's current streaming focus.

Peters stressed the company sees clear value in unlocking Warner's content library and optimizing HBO as a premium tier. Netflix currently holds just 8% of U.S. TV viewing hours, according to Nielsen data, trailing YouTube at 13%. Even combined with Warner, the merged entity would capture only 9% of viewing time, well behind potential rivals.

Netflix expects advertising revenue to more than double this year, driven by its proprietary ad server launched earlier this year. New demand sources, including Amazon (AMZN), have expanded targeting capabilities, while interactive ad formats are rolling out.

Management sees live programming as another growth lever, with international expansion planned after learning the U.S. market over the past two years. On AI integration, Netflix is applying machine learning across personalization, advertising, and production workflows. The focus remains on enhancing creative storytelling rather than simply cutting costs.

Gaming efforts are gaining traction across four key areas: immersive narrative games based on Netflix IP, safe spaces for kids, classic game distribution, and social party games designed for TV screens.

What Is the NFLX Stock Price Target?

Analysts tracking NFLX stock forecast revenue to increase from $39 billion in 2024 to $67.2 billion in 2029. In this period, adjusted earnings are forecast to expand from $1.98 per share to $5.10 per share.

If NFLX stock is priced at 30 times forward earnings, which is similar to its current multiple, it will trade around $153 in late 2028, indicating an upside potential of 60% from current levels.

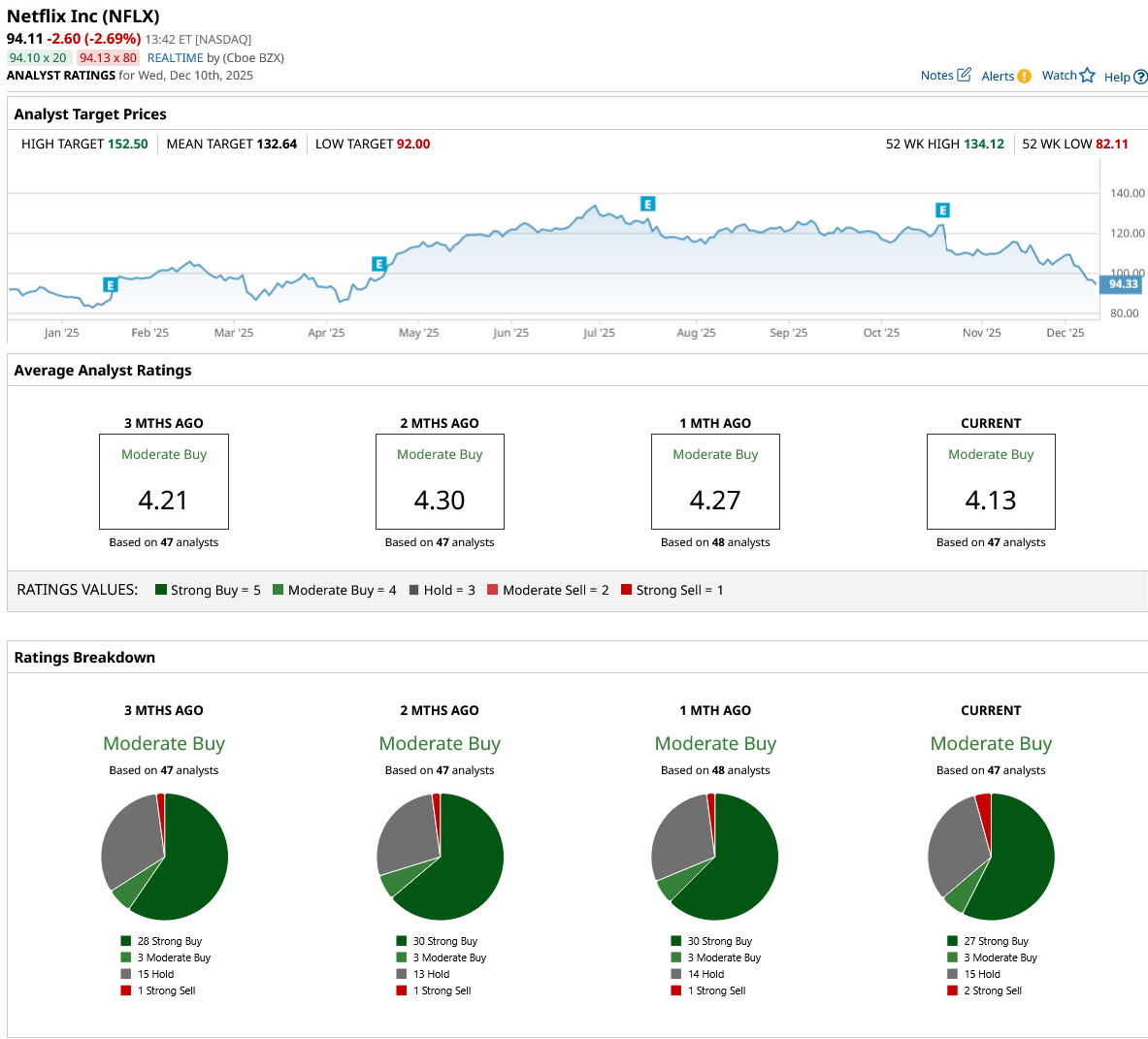

Out of the 47 analysts covering NFLX stock, 27 recommend “Strong Buy,” three recommend “Moderate Buy,” 15 recommend “Hold,” and two recommend “Strong Sell.” The average NFLX stock price target is $132.64, above the current price of $94.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart