Despite its $3.38 trillion market cap, having hyperscaler notoriety and a suite of critical productivity offerings that permeate our digital lives, the recent Microsoft (MSFT) stock performance has failed to reflect the company’s wide-reaching tendrils, with shares down more than 8% in the year to date.

Plus, Microsoft stock gained just 14.75% in 2025. Although that’s a solid number, it is relatively and historically disappointing for the tech giant’s shareholders.

The fact is the large-cap S&P 500 ($SPX) and Nasdaq Composite ($NASX) indexes, both of which feature Microsoft as a key constituent, achieved stronger returns of 18% and 21%, respectively, last year.

Also, Microsoft shares have averaged yearly returns of roughly 26% over the past decade. To that end, 2025 is on record as further evidence of an underwhelming performance for MSFT investors.

Those stats don’t tell the whole story either.

Shares of Microsoft are up just north of 2% since the summer of 2024. Yet over the same period, both the S&P 500 and Nasdaq have rallied handily with solid returns of 25% to 29%.

It’s also true that shares remain nearly more than 18% beneath their all-time high.

MSFT Stock Weekly Price Chart

Looking at Microsoft’s weekly price chart, the 18% correction over the past couple months has put shares into a lateral testing pattern of the stock’s prior high from July 2024.

The price consolidation is also finding support from the 38% and 50% Fibonacci levels tied to MSFT’s April cycle low to its July all-time high.

Also promising, Microsoft shares are trading against the lower Bollinger Band, while the weekly stochastics is in neutral territory and a whisker from a bullish crossover.

Less exciting for investors considering a purchase is that if the current lateral consolidation breaks price support, MSFT’s corrective phase could morph into a larger bear market.

The first area of significant price support is a 10% wide price band from roughly $390-$430 which holds longer-term Fibonacci levels and lower channel line.

That’s not out of the question.

Bear markets of 20% to 30% in individual stocks occur routinely, even in healthier markets where indexes are hitting new highs like they are right now.

So, will it be up or down from here, and will a nearby earnings announcement on Jan. 28 function as a substantial price driver in MSFT stock?

A Smart, Limited Risk Way to Invest in MSFT Stock

Stock ownership can be expensive. Especially if shares trade near $442 like MSFT (as of close Wednesday, Jan. 21). Just a 100-share position costs roughly $44,000.

And let’s face it, if your portfolio isn’t north of $500,000 or more, the percentage allocation for just one round lot of MSFT stock would be hard to justify.

If investors do have the financial resources, that’s great. Still, a sizable earnings reaction which averages 5.17% in Microsoft stock means a run-of-the-mill, adverse reaction could find even a 100-share position down a quick $2,289 thereabouts (($442.79 share price x .0517) x 100 shares)).

On the other hand, regardless of account size, with no shortage of bull call spreads that can be created where the risk is a much smaller, ironclad percentage of MSFT stock’s average earnings move, this is a terrific strategy to deploy in conjunction with prudent position sizing of 1% to 3%. You can learn more about bull call spreads here.

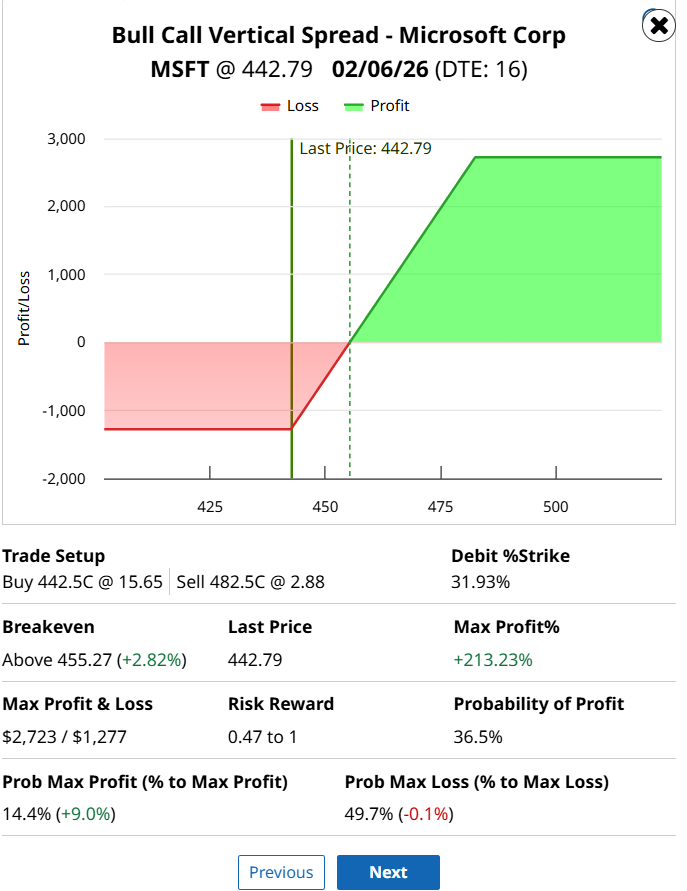

One weekly’s bull call spread that is attractive is the Feb 6 $442.50 / $482.50 combination. This vertical risks a modest 2.88% ($12.77 debit / $442.79 MSFT stock) of the share price and offers a payoff of 213% or $2,723 per spread.

While the structure is out of the money, the strike placement only demands a smaller bullish move of less than 3% to breakeven.

Technically, this size reaction would put shares mostly above the lateral congestion area that’s formed over the past six weeks. It wouldn’t be wrong to anticipate an even larger rally as the current 18% correction confirms a weekly pattern bottom.

This bull call spread also gives investors more than a week past the earnings event to find some additional price momentum and a higher MSFT share price to profit from.

The Bottom Line

This bull call spread won’t break the bank for smaller accounts, can potentially help larger investors with a more opportunistic stock purchase post earnings, and offers a decent profit without having to ask a lot from MSFT stock given its record and today’s circumstances.

On the date of publication, Chris Tyler did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.