Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

On Friday, February 13, 2026, the fragility of a highly concentrated stock market was laid bare as a 2.2% decline in Nvidia (NASDAQ:NVDA) single-handedly erased gains across dozens of other sectors. As the heaviest weighted company in the S&P 500 (NYSEARCA:SPY), Nvidia’s retreat acted as

Via MarketMinute · February 16, 2026

The American consumer entered 2026 with an unexpected burst of energy, defying the gravitational pull of high interest rates and "sticky" core inflation. According to data released in mid-February, January’s retail performance showed a resilient spending appetite that has bolstered the narrative of a "soft landing"—a scenario where

Via MarketMinute · February 16, 2026

While the broader technology sector spent the second week of February 2026 reeling from a "SaaSpocalypse" that wiped billions off the valuations of software giants, Applied Materials (NASDAQ:AMAT) emerged as a beacon of resilience. On Friday, February 13, 2026, shares of the semiconductor equipment powerhouse surged by more than

Via MarketMinute · February 16, 2026

As of mid-February 2026, the pulse of the American economy is beating at a steady, if cautious, rhythm. The benchmark 10-year U.S. Treasury yield is currently hovering near 4.07%, a level that market analysts are calling a "hard-won equilibrium." This positioning reflects a delicate balancing act between cooling

Via MarketMinute · February 16, 2026

In a move that has sent shockwaves through global debt and commodity markets, President Donald Trump officially announced his intention to nominate former Federal Reserve Governor Kevin Warsh as the next Chair of the Federal Reserve. The announcement, made in late January 2026, marks the beginning of the end for

Via MarketMinute · February 16, 2026

The first quarter of 2026 has delivered a stunning reversal of fortune for the global energy sector. After three grueling years of earnings contraction and market apathy, the sector exploded out of the gate in January 2026, posting a massive 14% gain that catapulted it to the top of the

Via MarketMinute · February 16, 2026

As of February 16, 2026, the narrative on Wall Street has undergone a startling transformation. The "growth-at-any-price" mentality that defined the early 2020s has been replaced by a resolute flight to quality, as investors abandon the high-octane technology sector in favor of the unglamorous but reliable world of household goods.

Via MarketMinute · February 16, 2026

The early 2026 financial results for Meta Platforms, Inc. (NASDAQ:META) have painted a picture of a company in the midst of a profound structural evolution. While the tech giant reported a staggering 24% year-over-year surge in advertising revenue—fueled by a revolutionary suite of artificial intelligence tools—its total

Via MarketMinute · February 16, 2026

The dawn of 2026 has brought a stark realization for the tech sector: the "AI Revolution" is as expensive as it is transformative. Microsoft Corp (NASDAQ: MSFT) recently reported its results for the quarter ended December 31, 2025, revealing a financial profile that would, in any other era, be celebrated

Via MarketMinute · February 16, 2026

The mid-February trading sessions for AppLovin Corp. (NASDAQ: APP) have sent shockwaves through the ad-tech sector, serving as a high-stakes litmus test for investor sentiment regarding artificial intelligence. After a staggering 20% collapse on Thursday, February 12, 2026, the stock staged a resilient 6.4% rebound on Friday, as the

Via MarketMinute · February 16, 2026

In a decisive victory for the fast-food giant, McDonald’s Corporation (NYSE:MCD) reported a staggering surge in sales this February 2026, marking its most robust growth period in over two years. The Chicago-based chain saw U.S. same-store sales jump 6.8% in the fourth quarter of 2025, a

Via MarketMinute · February 16, 2026

In a bold declaration that signals a new era of consolidation in the asset management industry, Victory Capital Holdings, Inc. (NASDAQ:VCTR) has officially set its sights on joining the elite "trillion-dollar club." Speaking at the UBS Financial Services Conference on February 10, 2026, Chairman and CEO David Brown detailed

Via MarketMinute · February 16, 2026

The software-as-a-service (SaaS) sector is reeling from a historic market correction that has wiped over $1 trillion in market capitalization in less than a month. As of February 16, 2026, industry bellwethers Salesforce (NYSE: CRM) and Adobe (NASDAQ: ADBE) have seen their share prices plummet by more than 25% since

Via MarketMinute · February 16, 2026

As of February 16, 2026, the American industrial landscape is undergoing a profound transformation, driven by a powerful synergy between fiscal policy and monetary easing. The legislative centerpiece of this shift, the "One Big Beautiful Bill" Act (OBBBA)—officially known as H.R. 1, Public Law 119-21—is now fully

Via MarketMinute · February 16, 2026

As of mid-February 2026, a profound shift is rattling the foundations of Wall Street. For over a decade, the narrative of the American stock market was one of extreme concentration, dominated by a handful of mega-cap technology titans that propelled indices to record highs. However, the tide has officially turned.

Via MarketMinute · February 16, 2026

The financial world witnessed a watershed moment in early February 2026 as the Dow Jones Industrial Average (DJI) finally shattered the psychological 50,000-point barrier, marking the fastest 10,000-point ascent in the index's 130-year history. This "Infrastructure Milestone" saw the blue-chip index reach a staggering intraday peak of 50,

Via MarketMinute · February 16, 2026

In a watershed moment for global equity markets, the S&P 500 (INDEXSP:.INX) briefly conquered the psychological 7,000-point milestone in late January 2026, marking the fastest 1,000-point ascent in the index's history. This historic peak, driven by a relentless "melt-up" in Artificial Intelligence (AI) valuations, saw the

Via MarketMinute · February 16, 2026

The tech sector is reeling this week as Amazon.com, Inc. (NASDAQ: AMZN) endured a historic nine-day losing streak, marking its longest consecutive daily decline in nearly two decades. The sell-off, which culminated in mid-February 2026, has seen the e-commerce and cloud giant’s stock plummet 23% from its record

Via MarketMinute · February 16, 2026

The United States economy reached a long-awaited milestone this week as the Bureau of Labor Statistics reported that headline inflation fell to 2.4% in January 2026, with the core Consumer Price Index (CPI) cooling to 2.5%. These figures represent the lowest inflationary readings since early 2021, signaling a

Via MarketMinute · February 16, 2026

NEW YORK — The floor of the New York Stock Exchange (NYSE: ICE) sits silent today, February 16, 2026, as the U.S. financial markets observe the Presidents Day holiday. While the closure provides a momentary reprieve for traders, the atmosphere remains charged with anticipation following a highly divergent week of

Via MarketMinute · February 16, 2026

As the financial world braces for the 2026 spring deal-making season, all eyes are on Donnelley Financial Solutions (NYSE:DFIN) as it prepares to release its fourth-quarter and full-year 2025 earnings tomorrow, February 17, 2026. The company, which has spent the last five years aggressively pivoting from a legacy printing

Via MarketMinute · February 16, 2026

The era of post-2025 market complacency officially came to a grinding halt this week. In a swift and decisive move that caught many retail traders off-guard, the CBOE Volatility Index (CBOE: ^VIX), widely known as the market's "fear gauge," surged 18% to close at 20.82. This move marks the

Via MarketMinute · February 16, 2026

SANTA CLARA, Calif. — February 16, 2026 — As the first quarter of 2026 unfolds, the semiconductor industry finds itself at a dizzying crossroads. Nvidia (NASDAQ: NVDA) continues to command a staggering 80% to 90% share of the global AI accelerator market, yet a shadow of "valuation fatigue" has begun to creep

Via MarketMinute · February 16, 2026

In a bold proclamation that has sent ripples through global financial markets, David Solomon, CEO of The Goldman Sachs Group Inc. (NYSE: GS), has signaled that 2026 is on track to become one of the most prolific years for mergers and acquisitions (M&A) in history. Speaking at the UBS

Via MarketMinute · February 16, 2026

In a move that has sent shockwaves through the Houston energy corridor and solidified the 2026 "merger mania" trend, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) officially announced a definitive agreement to merge in an all-stock transaction valued at $26 billion. The deal, revealed earlier this month on

Via MarketMinute · February 16, 2026

NEW YORK — The exuberant AI-driven rally that defined the middle of the decade has hit a formidable wall in February 2026. In a dramatic shift of market leadership, institutional capital is staging a massive "defensive rotation," abandoning high-growth technology stocks in favor of the reliable, if unglamorous, bastions of the

Via MarketMinute · February 16, 2026

In a move that has recalibrated expectations for the corporate credit market, Alphabet Inc. (NASDAQ: GOOGL) successfully executed a massive $32 billion multi-currency debt sale in mid-February 2026. The offering, which was significantly upsized from initial targets, highlights a staggering divergence between the cautious sentiment currently seen in global equity

Via MarketMinute · February 16, 2026

In a move that has sent shockwaves through the global battery metals sector, Albemarle Corporation (NYSE:ALB) officially announced on February 11, 2026, that it will idle the remaining operations at its flagship Kemerton lithium hydroxide plant in Western Australia. This decision marks the final chapter in a multi-year restructuring

Via MarketMinute · February 16, 2026

The United States labor market has entered a definitive cooling phase as of February 2026, signaling a major shift from the post-pandemic hiring frenzy. Recent data from the Bureau of Labor Statistics reveals that job openings (JOLTS) plummeted to 6.5 million in December 2025—the lowest level since late

Via MarketMinute · February 16, 2026

NEW YORK — In a resounding signal that the American industrial heartland has finally shaken off its post-pandemic lethargy, the U.S. manufacturing sector roared back into expansion territory in January 2026. The Institute for Supply Management (ISM) reported on February 2nd that its Manufacturing PMI rose to 52.6 last

Via MarketMinute · February 16, 2026

A sudden and violent shift in investor sentiment has sent shockwaves through the financial markets this week, as the "AI Scare Trade" moved beyond the software sector to target traditional, human-centric service industries. In a staggering two-session rout ending February 13, 2026, pillars of the old-guard economy saw their valuations

Via MarketMinute · February 16, 2026

The long-standing dominance of human-centric logistics giants faced its "reckoning moment" this week as a wave of panic regarding artificial intelligence disruption swept through the trucking and freight sectors. On Thursday, February 12, 2026, investors staged an aggressive retreat from established industry leaders, triggered by evidence that autonomous AI agents

Via MarketMinute · February 16, 2026

The managed-care sector faced a brutal reckoning this month as Humana Inc. (NYSE: HUM) unveiled its financial guidance for 2026, signaling a much slower and more painful recovery than investors had initially priced in. The healthcare giant’s projections have sent ripples across the industry, highlighting a "perfect storm" of

Via MarketMinute · February 16, 2026

On February 11, 2026, McDonald’s Corp (NYSE:MCD) reported fourth-quarter and full-year 2025 financial results that surpassed Wall Street’s most optimistic projections, signaling a dramatic turnaround for the fast-food giant. Following a year of sluggish traffic and public relations hurdles in late 2024, the company’s strategic pivot

Via MarketMinute · February 16, 2026

Equinix (NASDAQ: EQIX), the global leader in colocation and interconnection, saw its shares surge by more than 10% in early trading following the release of a blockbuster financial outlook for 2026. The rally, which pushed the stock toward historic highs, was fueled by a robust forecast that places the company

Via MarketMinute · February 16, 2026

The gold rush for Artificial Intelligence infrastructure has hit a significant roadblock, and the fallout is reverberating through the heart of the networking world. Cisco Systems (NASDAQ: CSCO) saw its stock price plummet nearly 13% on February 12, 2026, marking its steepest single-day decline in years. The sell-off came despite

Via MarketMinute · February 16, 2026

The long-awaited cooling of price pressures has finally arrived, providing a much-needed lifeline to a financial market battered by a chaotic start to the month. On February 13, 2026, the Bureau of Labor Statistics (BLS) released the January Consumer Price Index (CPI) report, revealing that headline inflation has decelerated to

Via MarketMinute · February 16, 2026

AUSTIN, Texas — Shares of Oracle Corporation (NYSE: ORCL) surged 9.6% this week, marking one of the tech giant's strongest trading sessions of the year. The rally was ignited by a high-profile analyst upgrade and sustained by the official announcement that the Centers for Medicare and Medicaid Services (CMS) has

Via MarketMinute · February 16, 2026

The second week of February 2026 will be remembered in financial history as "Software-mageddon," a period of unprecedented volatility that saw the S&P 500 Software Index plummet by 13% in just five trading sessions. This massive selloff, which erased more than $800 billion in market value, was fueled by

Via MarketMinute · February 16, 2026

The American financial landscape entered a new era this month as the Dow Jones Industrial Average crossed the psychological and symbolic 50,000 milestone for the first time in history. On February 6, 2026, the blue-chip index shattered its previous ceilings, closing at 50,120.45 in a session characterized

Via MarketMinute · February 16, 2026

The United States banking sector has entered a transformative era of consolidation in early 2026, with merger and acquisition (M&A) activity reaching levels not seen since 2019. Driven by a "perfect storm" of regulatory clarity, the urgent need for technological scale, and a hunt for stable deposit bases, the

Via MarketMinute · February 16, 2026

NEW YORK — Financial markets are breathing a collective sigh of relief this week as the White House officially pivoted from a confrontational "purchase-or-tariff" stance regarding Greenland toward a collaborative diplomatic framework. The shift, dubbed the "Arctic Thaw" by analysts, has effectively dismantled a looming trade war with European allies and

Via MarketMinute · February 16, 2026

The financial world reached a staggering new frontier this month as the S&P 500 surged past the 7,000-point milestone for the first time in history. On February 16, 2026, the market remains in a state of high-octane anticipation, buoyed by a "perfect storm" of cooling inflation, a pivot

Via MarketMinute · February 16, 2026

In a move that has sent shockwaves through global financial markets, Kevin Warsh has been officially nominated by the White House to serve as the next Chairman of the Federal Reserve. The announcement, made on January 30, 2026, positions the 55-year-old former Fed Governor to succeed Jerome Powell, whose term

Via MarketMinute · February 16, 2026

As of February 16, 2026, the American economic landscape has split into two starkly different realities, creating a "K-shaped" trajectory that financial experts warn could be the precursor to a significant market correction. This divergence—where high-income earners continue to see their wealth expand while middle- and lower-income households struggle

Via MarketMinute · February 16, 2026

In early 2026, the global energy landscape is witnessing a structural transformation as the legendary U.S. shale boom—the force that upended global oil markets for over a decade—has finally hit a definitive plateau. As of February 16, 2026, latest data from the Energy Information Administration (EIA) confirms

Via MarketMinute · February 16, 2026

In late January 2026, Apple Inc. (NASDAQ: AAPL) once again silenced skeptics by reporting a record-shattering $143.8 billion in quarterly revenue, marking its most successful holiday season in history. This milestone, driven by a massive "AI supercycle" for the iPhone 17 and a burgeoning high-margin services business, has propelled

Via MarketMinute · February 16, 2026

WASHINGTON D.C. — In a dramatic escalation of the conflict between Silicon Valley’s safety-first ethos and the federal government’s "wartime" AI doctrine, the Department of War has moved to the brink of blacklisting Anthropic, one of the world's leading artificial intelligence firms. Secretary of the Department of War

Via MarketMinute · February 16, 2026

In a startling paradox that has left market veterans scratching their heads, February 2026 has become the month where "beating and raising" was no longer enough for Silicon Valley’s elite. Despite posting some of the strongest financial results in their respective histories, software and networking giants found themselves in

Via MarketMinute · February 16, 2026

The mid-February 2026 trading sessions have marked a decisive shift in investor sentiment, as the high-flying momentum of the previous year gives way to a calculated "flight to safety." In a dramatic rotation that has caught many growth-oriented traders off guard, the Utilities sector has rocketed by 6.9% in

Via MarketMinute · February 16, 2026

The tech-heavy Nasdaq Composite (INDEXNASDAQ: .IXIC) has finally halted its most grueling losing streak in nearly four years, ending a five-week downward spiral on February 13, 2026. This period of intense selling, which investors have dubbed "Software-mageddon," represents the longest consecutive weekly decline for the index since the interest rate

Via MarketMinute · February 16, 2026

The U.S. Bureau of Labor Statistics released the January Consumer Price Index (CPI) report this week, revealing a headline inflation rate of 2.4% year-over-year. This figure came in cooler than the 2.6% consensus estimate, marking a significant milestone in the Federal Reserve’s long-standing battle to return

Via MarketMinute · February 16, 2026

In a bold proclamation that has sent ripples through the global financial markets, David Solomon, the Chairman and CEO of Goldman Sachs (NYSE:GS), predicted that 2026 is on track to become one of the most prolific years for mergers and acquisitions in history. Speaking at the UBS Financial Services

Via MarketMinute · February 16, 2026

In a move that signals a seismic shift in the American banking landscape, Fifth Third Bancorp (Nasdaq: FITB) has officially completed its $12.3 billion acquisition of Comerica Incorporated (NYSE: CMA). Finalized on February 2, 2026, the merger creates the ninth-largest bank in the United States, commanding approximately $294 billion

Via MarketMinute · February 16, 2026

As the oncology community prepares to descend upon San Francisco for the 2026 ASCO Genitourinary (GU) Cancers Symposium from February 26–28, investors and clinicians alike are bracing for data that could redefine the standard of care in bladder and kidney cancers. With the conference just ten days away, the

Via MarketMinute · February 16, 2026

In a move that could reshape the multi-billion-dollar retinal disease market, French pharmaceutical giant Sanofi (NASDAQ: SNY) has reportedly returned to the negotiating table with a significantly "sweetened" revised bid for Ocular Therapeutix (NASDAQ: OCUL). The updated offer comes at a high-stakes moment for the biotech industry, as Ocular Therapeutix

Via MarketMinute · February 16, 2026

The multi-billion dollar wet Age-Related Macular Degeneration (wet AMD) market is standing on the precipice of a transformative shift. Today, February 16, 2026, Ocular Therapeutix (NASDAQ: OCUL) is in its final "quiet period" before releasing the highly anticipated topline results for its SOL-1 Phase 3 trial. The data, expected to

Via MarketMinute · February 16, 2026

Investors and policymakers are bracing for one of the most consequential mornings in recent financial history. This Friday, February 20, 2026, the U.S. government will release a consolidated "data dump" featuring the advance estimate for fourth-quarter 2025 Gross Domestic Product (GDP) and the December 2025 Personal Consumption Expenditures (PCE)

Via MarketMinute · February 16, 2026

In a high-stakes forecast that has captured the attention of retail investors and institutional desks alike, analysts at UBS Group AG (NYSE:UBS) have released a strikingly optimistic earnings preview for Walmart Inc. (NYSE:WMT). As the retail giant prepares to pull back the curtain on its fourth-quarter results for

Via MarketMinute · February 16, 2026

In a historic shift for the global equity markets, Walmart Inc. (Nasdaq:WMT) officially crossed the $1 trillion market capitalization threshold on February 3, 2026. The milestone marks the first time a traditional "brick-and-mortar" retailer has ascended to the valuation heights previously dominated by Silicon Valley’s technology elite. This

Via MarketMinute · February 16, 2026

As of February 16, 2026, the global energy market finds itself trapped in a violent "tug-of-war" between gravity-defying geopolitical tensions and a relentless structural supply glut. While the International Energy Agency (IEA) has sounded the alarm on a massive projected surplus of nearly 4 million barrels per day (bpd) for

Via MarketMinute · February 16, 2026

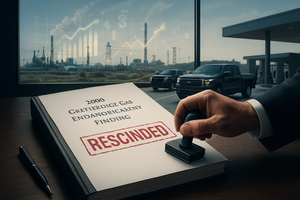

In a move that has sent shockwaves through the global automotive and energy markets, the Environmental Protection Agency (EPA) finalized a rule on February 12, 2026, rescinding the landmark 2009 Greenhouse Gas Endangerment Finding. This historic decision effectively dismantles the legal foundation for federal greenhouse gas (GHG) regulations under the

Via MarketMinute · February 16, 2026

In a legal battle that could reshape the logistics of the American breadbasket, Weskan Grain LLC and a coalition of 13 local farmers have filed a major antitrust lawsuit against rail giant Union Pacific Railroad Company (NYSE: UNP) and the Kansas & Oklahoma Railroad (K&O). Filed in late January 2026

Via MarketMinute · February 16, 2026

As of mid-February 2026, the cattle futures market finds itself in a precarious tug-of-war, characterized by a persistent technical "chop" that has left traders searching for a definitive direction. While the underlying fundamentals—including the tightest cattle supply in seven decades—point toward a bullish horizon, the charts tell a

Via MarketMinute · February 16, 2026

The U.S. Department of Agriculture (USDA) sent a wave of relief through the agricultural sector this week with the release of its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report. Defying expectations of a mounting supply glut following last year’s historic production, the agency slashed projected

Via MarketMinute · February 16, 2026

Soybean futures have experienced a dramatic 60-cent rally over the past two weeks, as market optimism builds around a potential breakthrough in US-China trade relations. Reports circulating in Washington and Beijing suggest that President Trump and President Xi Jinping are finalizing plans for a high-stakes summit in April 2026. The

Via MarketMinute · February 16, 2026

Copper futures drifted lower this week, settling near the $5.90 per pound mark as the global commodities market grapples with a seasonal slowdown in China. As the world’s largest consumer of the "red metal," China’s transition into the Lunar New Year holiday has led to a significant

Via MarketMinute · February 16, 2026

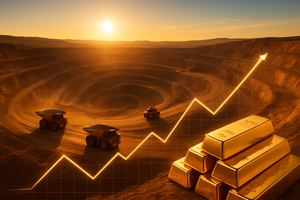

Gold prices have successfully established a new psychological floor, holding steady above the $5,000 per ounce mark following a period of historic volatility. This stabilization comes as institutional investors and sovereign entities recalibrate their portfolios in response to a shift in U.S. monetary leadership and persistent global geopolitical

Via MarketMinute · February 16, 2026

In a decisive move that has sent shockwaves through global energy markets, Saudi Arabia has officially abandoned its long-held, unofficial target of $100 per barrel for crude oil. By mid-February 2026, the Kingdom has fully pivoted toward a "volume over value" strategy, signaling a willingness to endure lower prices in

Via MarketMinute · February 16, 2026

The precious metals market is currently reeling from a "liquidity rupture" that has redefined modern commodity trading. In early February 2026, a sudden and violent correction saw silver experience a record 35% single-day collapse, while gold plummeted 12% from its all-time highs. This seismic shift was not driven by a

Via MarketMinute · February 16, 2026

Energy markets were jolted into a high-volatility state this month as West Texas Intermediate (WTI) crude surged to the $65.00 mark, driven by the abrupt cancellation of high-stakes nuclear negotiations between Washington and Tehran. The talks, which were scheduled to take place in Istanbul, Turkey, fell apart after a

Via MarketMinute · February 16, 2026

As of February 16, 2026, the global gold mining industry has officially entered what analysts are calling a "Golden Age" of profitability. With spot gold prices comfortably sustained above the $4,500 per ounce mark—peaking as high as $5,595 in recent weeks—the world’s largest producers are

Via MarketMinute · February 16, 2026

As of February 16, 2026, the global financial landscape has been fundamentally reshaped by a "yellow metal" fever that shows no signs of breaking. Gold has shattered psychological barriers once thought insurmountable, trading near a record $5,000 per ounce. Despite these stratospheric valuations, the People’s Bank of China

Via MarketMinute · February 16, 2026

NEW YORK — The global silver market has entered a transformative era of volatility and geopolitical maneuvering, culminating in what analysts are calling the "Great Revaluation of 2026." Following a parabolic surge that saw silver prices touch an all-time high of $120 per ounce in late January, the metal has since

Via MarketMinute · February 16, 2026

The global financial landscape was fundamentally reshaped on January 30, 2026, by what is now being called the "Warsh Shock." The nomination of Kevin Warsh as the next Chair of the Federal Reserve sent shockwaves through the commodities market, ending a multi-year parabolic rally in precious metals. Gold, which had

Via MarketMinute · February 16, 2026